Contour collapses: What does this mean for digital trade finance?

Originally posted in Trade Finance Global

Digital trade finance platform Contour has announced its closure, citing insufficient funding from its bank shareholders.

Operations will cease on November 30, leaving users a brief window to complete transactions and download essential data. This development was first reported by Global Trade Review (GTR).

Contour was launched in 2020 by a group of leading banks, including ANZ, BNP Paribas, HSBC, and Standard Chartered, with the aim of digitising and streamlining the documentary trade process.

The platform allowed banks and corporates to issue, manage, and process letters of credit (LCs) electronically.

At its peak, Contour boasted a network of 21 banks and a range of partners across various sectors. Contour also had a number of integration and documentation partners, including Finastra, CargoX, Bolero and Surecomp.

However, despite its advantages, Contour was unable to attract enough users to its platform. As a result, it was unable to generate enough revenue to cover its costs.

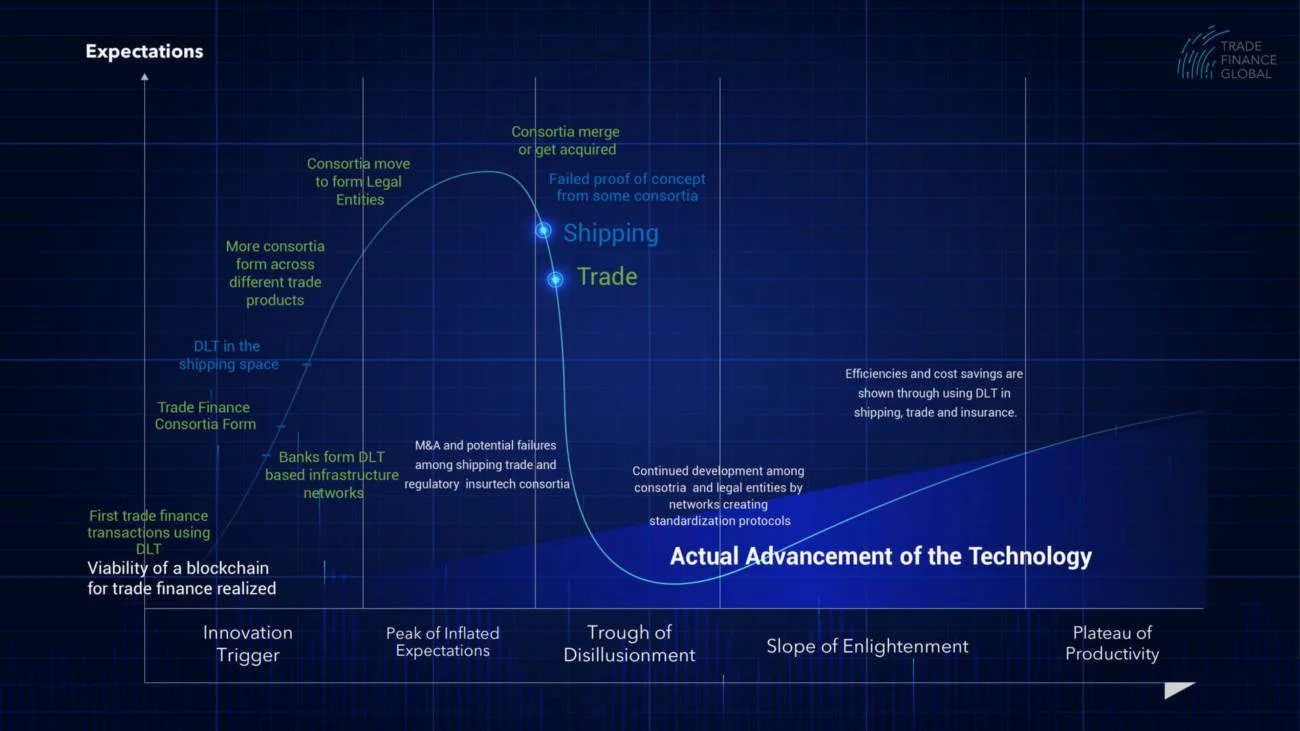

Contour joins a growing list of platforms that have failed to sustain themselves, including Marco Polo, we.trade and Tradelens. These platforms, despite their initial promise, have struggled to achieve the scale and interoperability needed for long-term viability.

History of Contour

Contour’s journey began in April 2018 with global banks testing next-generation technology for trade finance on R3’s Corda platform.

The platform had several milestones.

By February 2019, a global trial explored the benefits of enterprise distributed ledger technology (DLT) for Documentary Trade.

The commercial launch of Contour’s Beta network occurred in January 2020, followed by its official launch into live production in October of the same year.

The platform collaborated with Finastra to offer a new digital trade finance network, aiming to bring together banks and corporates globally. Other significant partnerships were with Tata Power, IBM TradeLens (prior to its collapse), and the Shenzhen FinTech Institute of the People’s Bank of China.

The platform also partnered with the Global Legal Entity Identifier Foundation (GLEIF) to enable Legal Entity Identifier (LEI) usage, aiming to create a more transparent trading environment.

In addition to its various partnerships and milestones, Contour had embarked on a next phase focused on tokenising digital trade assets (listen to our podcast, with Contour).

The concept was to allow corporates to originate an asset and either maintain it on their balance sheet or sell it to a bank. Banks could then package, securitise, and sell multiple transactions to investors in the secondary market.

The first round of digital assets to be minted on Contour would likely have been unfunded bank risk or LC confirmations.

This ambitious phase aimed to bring decentralised finance (DeFi) technology to trade finance, connecting borrowers to new groups of lenders and potentially narrowing the trade finance gap.

However, despite this forward-thinking approach, Contour could not sustain its operations, adding another layer of complexity to its story of innovation and struggle.

The platform’s journey shows a consistent effort to innovate and collaborate. However, it also highlights the challenges of achieving scale and interoperability in a fragmented industry. Contour’s closure adds another chapter to the ongoing narrative of digital trade finance platforms struggling to find a sustainable path.